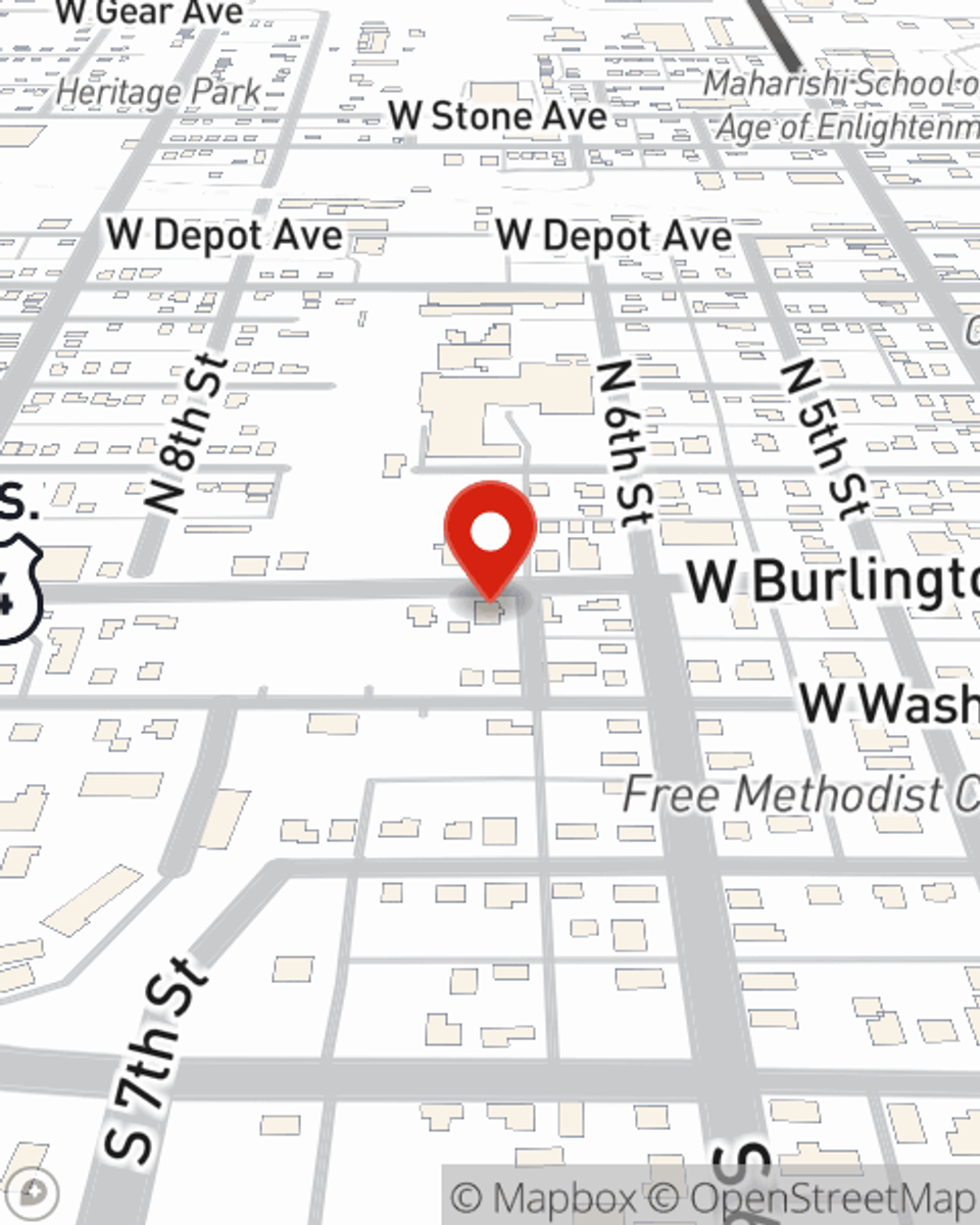

Renters Insurance in and around Fairfield

Get renters insurance in Fairfield

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Fairfield

- Ottumwa

- Keosauqua

- Mt. Pleasant

- Washington

- Lockridge

- Libertyville

- Richland

- Packwood

- Brighton

- Birmingham

- Stockport

- Bonaparte

- Farmington

- Keota

- Batavia

- Wayland

- Winfield

Home Sweet Home Starts With State Farm

There's a lot to think about when it comes to renting a home - price, parking options, utilities, condo or house? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Fairfield

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

The unanticipated happens. Unfortunately, the personal belongings in your rented property, such as a coffee maker, a microwave and a stereo, aren't immune to smoke damage or tornado. Your good neighbor, agent Shawn McCarty, is dedicated to helping you know your savings options and find the right insurance options to protect your belongings from the unexpected.

It's always a good idea to make sure you're prepared. Reach out to State Farm agent Shawn McCarty for help learning more about options for your policy for your rented property.

Have More Questions About Renters Insurance?

Call Shawn at (641) 472-5750 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Shawn McCarty

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.